A few months back, Russell Lord, our illustrious web designer from Sparkfactor interviewed Melissa Neis about how we’ve integrated blogging into our marketing strategy. While for many business, blogging may be a marketing no-brainer, its a less commonly used channel in the insurance industry. Our conversation with Russell really helped us clarify why we make the effort…

Homes Blog

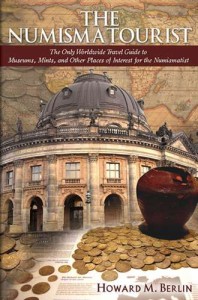

Dr. Howard M. Berlin, the Numismatourist

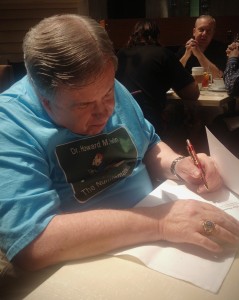

This week Tom had the pleasure of lunching with our friend and distinguished numismatist Dr. Howard M. Berlin, in town for the ANA World’s Fair of Money held August 5-9th at the Donald Stephens Convention Center in Rosemont, IL. With massive displays of modern and ancient tokens, coins and artifacts, the show attracts numismatists, collectors and buyers from around the world to learn about the field’s latest strategies and opportunities. The star of this year’s show was the rare 1787 Brasher Doubloon, graded NGC MS63 and insured for $10 million.

Dr. Berlin’s recently released book The Numismatourist, a first-of-its-kind travel guide for the numismatist. The book describes over 150 museums, mints and central banks across 75 countries and five continents. In addition to several books on coins and bank notes and other topics of varied interest, he has also written for WorldWide Coins, Coin World, Paper Money Values, The Banknote Report and The Shekel.

Are you a numismatic hobbyist? Do you suspect your collection could be considered rare or valuable? Do you have questions about valuation and insurance? We can help! Contact us today and we will put you in touch with Dr. Berlin or a numismatic appraiser in your area to make sure your collection is adequately valued and protected.

Real Estate Bisnow Chicago names Marcel one of “Real Estate’s Top Dogs”

We are proud to announce that the real estate industry e-Publication Real Estate Now recently named Marcel one of Chicago’s “Top Dogs” in real estate. They write:

“This is three-month-old Marcel, Parr Insurance Brokerage’s apprentice and intellectual Swiss Mountain puppy. Parr’s Tom Neis says Marcel will be able to fill your dog’s business background questions on building and apartment insurance when that information is needed as a risk mitigation technique. (Some dogs can mitigate risk better than others. They’re the ones that go outside, not in your shoe.)”

Introducing Our Newest Team Member

Dwight Zivo has been named vice president of marketing for Chicago-based Parr Insurance Brokerage. In his new role, Zivo will be responsible for developing and executing the marketing and brand strategy for the company, which serves high-net-worth individuals and families nationwide with customized insurance coverage.

Dwight Zivo has been named vice president of marketing for Chicago-based Parr Insurance Brokerage. In his new role, Zivo will be responsible for developing and executing the marketing and brand strategy for the company, which serves high-net-worth individuals and families nationwide with customized insurance coverage.

A 28-year veteran of the insurance industry, Zivo has a proven track record of building and managing successful insurance agencies. Most recently, Zivo was the owner and founder of Chicago-based NB Independent Brokerage, an independent financial services agency licensed in both property/casualty, life/health and merchant processing services.

Zivo, a Chicago resident, also was the owner of Dwight D. Zivo Insurance Agency Inc., a property and casualty firm serving a wide-range of clients from small personal lines to large commercial accounts.

Zivo is a licensed CPA with extensive senior management experience in the insurance sector of public accounting. He received a bachelor’s of science degree in accounting from Illinois Wesleyan University in Bloomington, Ill.

Click here for coverage in Insurance Journal – Midwest.

IIT Institute of Design Strategy Conference

Patrick Whitney of IIT Institute of Design, Don Norman of Nielsen Norman Group and Roger Martin of Rotman School of Management discuss design and strategy.

Tom Neis and Melissa Neis Wittenborn attended the 2014 IIT Institute of Design Strategy Conference, a two day event held annually in Chicago. The conference explores how design thinking can optimize company strategy through practical, user-focused solutions. Executives from Steelcase, Intuit, Logitech and United Healthcare shared their organizational successes implementing design tactics, while the Institute’s professors offered academic insight on trendy topics like big data, privacy, and research methodology.

Drawing from disciplines like engineering, social sciences, business, and the arts, design thinking uses various tools to uncover the human needs at the core of a product or business problem. Then, after extensive research and brainstorming, designers create prototypes to help visualize and refine ideas. The goal: to create empathetic and user-focused solutions to complex issues.

As technological innovation continues to propel market disruption, it’s no wonder that many businesses are looking to retain market share by improving user experience. Across all industries big businesses are adding design teams to tackle major problems. Even business schools are including qualitative design methodologies in their curriculum as a supplement to more traditional quantitative analysis.

The past few years have seen a design and innovation bonanza. If the design achievements explored at the Strategy Conference offer any indication, the role of design will only become more integral to how businesses shape strategy and solve core problems. And in the insurance industry, we look forward to it! Our industry has remained largely static for decades. We sell products that are often misunderstood by the public though arguably outmoded distribution channels. We certainly don’t have to look far for opportunities to improve customer experience.

At Parr Insurance Brokerage, we continuously seek out new ways to deliver relevant and cutting edge products to our customers, but sometimes it takes an educational experience like the Design Strategy Conference to inspire truly innovative ideas.

A special thanks to Ashley Lukasik the Director of Corporate Relations, Communications & Marketing at IIT Institute of Design for inviting Parr Insurance to this fantastic, thought provoking event.

Should Condo Associations Restrict Rental Units?

Pictured: Mary Markis of Perl Mortgage, Walt Teichen of Parr Insurance Brokerage, and Michael Shenfeld of The Shenfeld Group

Parr’s insurance adviser Walt Teichen joined a panel of industry experts at 1150 N. Lake Shore Drive to discuss the impact that rental units have on condominium buildings. Since the real estate market crash, there has been an uptick in condos available for rent. Condo owners are holding onto investment properties that won’t sell, causing their owner-occupied neighbors to appeal to the association for rental restriction bylaws.

And who could blame them? Renters make less desirable neighbors. They don’t have a stake in the property, and simply don’t care as much about the character of the development. In fact, most insurance companies perceive high rental occupancy as a sign of instability. Condominium associations should beware: when your rental percentage exceeds 10%, your building’s insurance policy will likely be surcharged. In fact, many standard markets wont even offer building coverage if the rental percentage surpasses this mark.

If your condo building allows rental units, there are a number of measures that the condo association should take to mitigate risk, such as:

- Requiring copies of the sublet contracts between owner and tenant

- Requiring proof of insurance from every tenant

- Requiring notification of vacancy

- Establishing specific rules in the bylaws regarding subletting

The exact number of allowable rental units in any given property is not boilerplate and should be based on a number of factors unique to each complex. If you would like to learn more about condominium association insurance, please contact Walt today: walt@parrinsurancebrokerage.com.

The Importance of Being Ergo

If you’re like us, work can have you hunched over your computer for hours on end, and monthly massages are just the cost of doing business. But do they have to be?

We were visited today by our good friend and workplace safety guru, Kristen Heitman. As a Certified Ergonomics Assessment Specialist, Kristen had some tips and tricks to help make work less of a pain in the neck.

Inadequate Liability Insurance May Prove Costly For Wealthy Families

Inadequate Liability Insurance May Prove Costly For Wealthy Families

Risk Factors, Level of Damages Often Underestimated

By Melissa Neis

Vice President

Parr Insurance Brokerage, Chicago

How does one’s financial success become a costly liability – literally?

It happens when a high net worth individual or family becomes the target of a successful multi-million-dollar liability lawsuit and the damages awarded far exceed the coverage provided by insurance. And it happens with greater frequency than one would expect.

Unfortunately, a number of wealthy individuals do not devote enough attention or time to best protect their financial assets and future earnings. They tend to underestimate the multitude of risk factors their lifestyles present and the high levels of liability damages often awarded. The affluent need to understand that if an accident or other incident occurs, an excess liability policy is essential to cover costs that could go well beyond the coverage provided by their existing insurance policies. This article explores these issues and outlines how to address them.

Insuring Your Home

In today’s economy, a home’s market value, or what it would sell for, is often much lower than what it would cost to rebuild. In fact, over the past several years home replacement costs have increased while market values have decreased. This informative video demonstrates the importance of insuring your home to the proper value so that you have enough insurance to rebuild your home to its previous condition in the event of a loss: